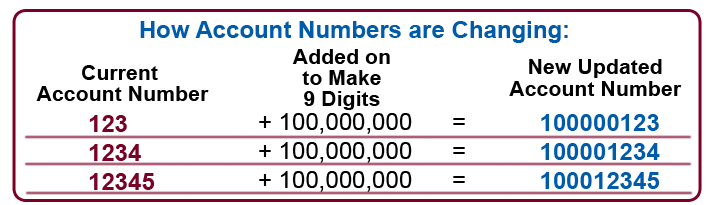

Yes, after October 1st Penobscot County members went to a nine-digit account number format. Your account number automatically changed by adding a one (1) and the quantity of zeros (0) needed to bring it to the new nine-digit format. For example, if your old account number was 123, your new account number is 100000123. As another example, if your account number was 12345, then your new account is 100012345.

Please use your updated account number format after October 1, 2021.

If your account number begins with 900 (nine zero zero), then your account number did not change. If you are an Online Banking user, please keep this new account number formatting in mind when you re-register for Online or Mobile Banking.

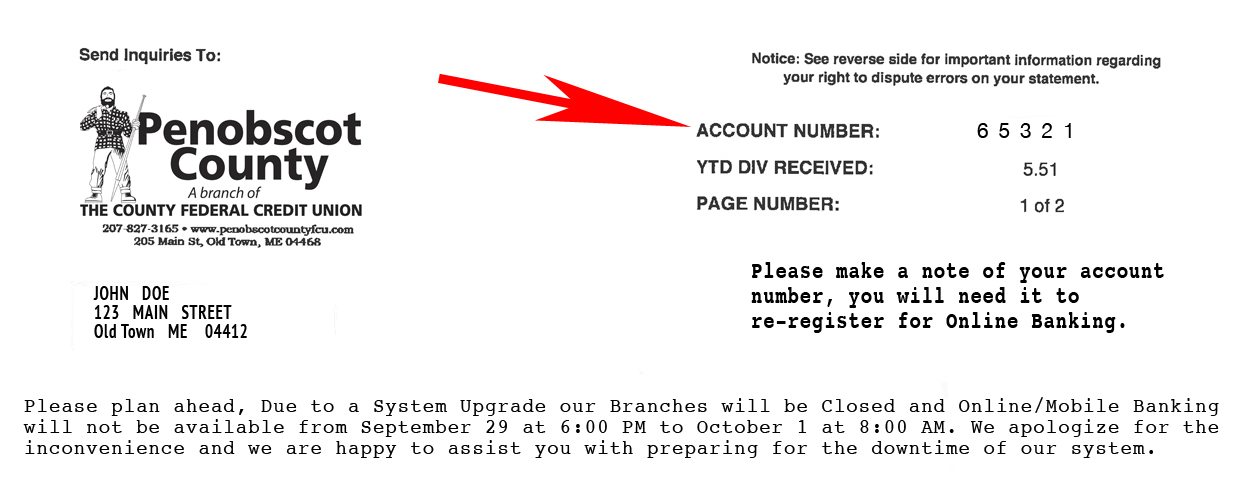

Your Membership Account Number also know as your Share Account Number was provided to you on your Membership Identification Card when you originally became a member. It is NOT your Checking Account Number or the number at the bottom of your checks. If you have misplaced your Membership Card, you can find your Member Number in the top right-hand corner of your monthly statement. Your Membership Number is also sometimes referred to as, your “Savings” Account Number.

PLEASE NOTE: Beginning October 1st, account numbers automatically changed by adding a 1 (one) and the number of zeros to make it into a nine-digit format, so in this example, John Doe’s new Account Number will be 100065123.

Please stop by our Bangor, Old Town or Howland branches to update your information. You can also update your contact information by calling our Member Services at 888-827-3165.

The Round-It-Up Feature helps members put money in their Savings Account for Effortless Savings!

To enjoy the Round-It-Up Feature, members must establish a YES Checking Account with debit card access, online banking, and e-Statements at your Credit Union. When the Round-It-Up Feature is activated with your YES Account, the amount of any debit card purchase you make is rounded up to the nearest whole dollar. The difference between the purchase amount and the whole dollar amount will be transferred from your share draft account to your share (savings) account.** This makes adding money to your savings account really easy.

**If the full rounded-up amount to be transferred is not available in the draft account at the time of the transaction/purchase, only the available amount will be transferred. If the share has a $0.00 balance or less, a transfer will not occur. Each day during the end-of-day processing, the aggregate rounded-up amount will be transferred into your share account. After you have chosen the Round-It-Up Feature, you can request that CFCU turn it off 30 days or more after account opening. The Round-It-Up feature will not be turned on again for at least six months after being turned off. Members must use their debit card 15 times in one statement cycle, to waive the $5 monthly fee. Members can opt out of the Round-It-Up Feature by calling our Member Service Center at 877-318-3838 or by stopping into any branch.

No, we will continue to clear items through both the Penobscot County FCU routing and transit number 211288158 and The County FCU routing and transit number 211288006 for the foreseeable future. However, after October 1, 2021, if you set up any new direct deposits or automatic withdrawals, please use The County FCU routing and transit number of 211288006.

No, you will not need to order new checks. The Checking Account number on the bottom of your checks will not change. Your Penobscot FCU checks will work just fine. Your checks will be updated with our new logo on your next order.

Yes, your direct deposits and automatic withdrawals will continue to post to your account just as they have in the past.

Starting October 1, 2021, if you set up any new direct deposits or automatic withdrawals, please use your new routing and transit number of 211288006 and either your updated Account Number for Savings transactions or your existing Checking Account Number for checking transactions.

No, you can continue using your debit card without any changes.

Yes, you will see no change in your payroll deductions, automatic payments, or scheduled transfers. Everything will still come into the same accounts and distribute to the accounts requested.

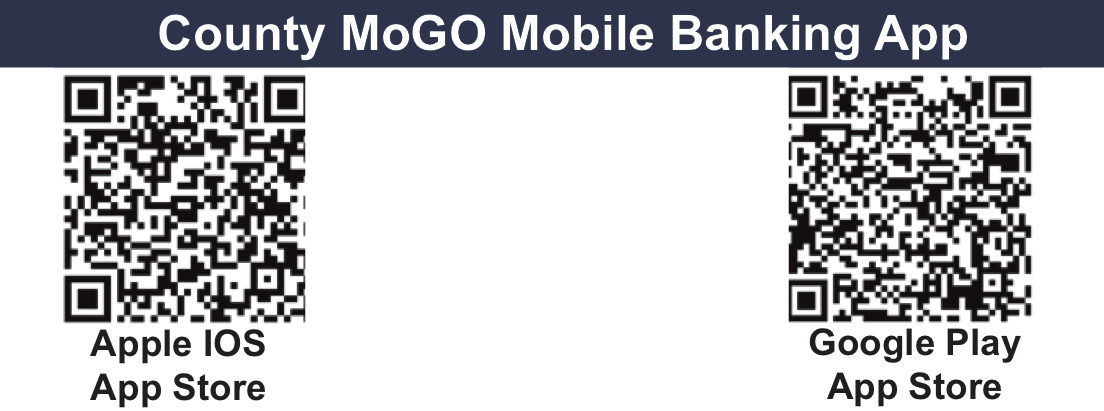

With the system upgrade on October 1st, both the mobile app and the online banking were upgraded as well. To begin using our mobile banking app again, please go to your device’s app store (scan QR code here) and download County MoGO mobile banking app. Once downloaded you can re-register for the service. If you are an Online Banking user, click on the Online Banking button at the top of the homepage, then click on “Register”, answer the series of questions, choose a username and password, accept the terms and begin enjoying Online Banking. Should you need assistance, please don’t hesitate to call our Member Service Center at 877-318-3838 or view our Tutorial by clicking here.

Remember, your account number has changed, and to reregister for Online Banking or Mobile Banking you will need your newly formatted Account Number. Get help here to know what your new account number is.

In keeping with our mission to provide financial services that enhance and simplify our members’ financial life, we have selected a seamless fully integrated digital banking platform. This solution aims to bring the next generation of digital banking services with security enhancements to our members.

A: Yes, both Online Banking and the mobile banking app changed to a new platform on October 1, 2021.

The new platform will provide a simplified Online and County MoGO Mobile Banking experience. You will also have enhanced security, new features, and functionality.

Convenient

- Single sign-on for online and mobile banking.

- Display responds to all device sizes.

- Universal experience for online and mobile banking.

Secure

- Enhanced security with two-factor authentication.

- Touch ID and facial recognition now available for newer Android devices.

New Features

- Card Controls – freeze activity in the event lost or stolen.

- Easier access to all of the accounts you are associated with including all Checking/Savings deposit accounts, Auto/Personal Loans, Home Equity/Mortgage Loans, and Bill Pay information.

Yes, because the new platform has enhanced security features and even though you are registered for the previous platform, you will need to take a few minutes to Reregister your account in the new system. Please follow these steps to Register:

1. On or after October 1st, Click on the Online Banking button on the home page to be taken to the new online banking

2. Click on the REGISTER button

3. Fill in the information needed to identify your account

Information you will need are:

• The last four digits of your Social Security Number

• Your Membership Savings Account Number that is on your membership card or the top right-hand corner of your monthly statement. Be sure to use the new nine-digit numbering format.

• Your Date of Birth

4. Confirm your contact information

5. Create a new username and password for your account

Link to Tutorial Here

6. Make up a Security Phrase then Select and answer your security questions

7. Check off the “Accept terms and conditions” box and click on the “Confirm and Enroll” button.

Once you log in using your new credentials, you will see your accounts successfully migrated over to the new system that your social security number is associated with. No additional work on your part is needed. It is always best to take an inventory of your accounts on any new system. To be safe, take a few minutes to:

- Check that all your accounts and transactional history are showing correctly.

- If you use bill pay, you will most likely need to re-establish your payees, and if not check your Bill Pay history and review your payees’ information.

- If any information looks off or you have questions about your account information, please contact us. With any upgrade, we expect higher than normal call volume. Therefore, we encourage you to use the online resources for quick answers.

- For the best experience with the new Online Banking features, we recommend updating your browser to the latest version. The Internet Browsers that work best are:

- —Microsoft Edge

- —Firefox

- —Safari

- —Chrome

DO NOT use Internet Explorer (IE), it is not compatible with the new system. Please update for free, to one of the browsers mentioned above.

Yes, mobile banking users will need to go to their device’s app store and download the County MoGO mobile banking app. The app is free, and once downloaded you can re-register using the app. Scan your device’s QR code below.

A: Yes, all existing transfers will continue to work as they did before the upgrade.

A: After the upgrade, all accounts for which you have an ownership role (primary or joint) or your social security number is associated with, will now be visible in online and mobile banking.

A: Yes, you can hide and unhide accounts displayed on your homepage. Navigate to the Account Preferences screen under the Settings menu in online & mobile banking.

A. For Penobscot County members, it’s a brand new app. You will see major changes to the Online Banking interface and the County MoGO mobile banking app. They are both extremely intuitive and customizable.

Don’t see your question here?

Send us an email to memberservice@countyfcu.org or give us a call at 1-877-318-3838 during regular business hours and we would be happy to answer all your questions.

Auto Loans

Auto Loans  Apply for a Loan

Apply for a Loan  Supervisory Committee Suggestion "Box"

Supervisory Committee Suggestion "Box"